Energy efficient home upgrades can make a measurable difference in your utility bills, overall comfort, and your home’s future resale value. But choosing which upgrades to prioritize—and understanding today’s real savings and pitfalls—requires up-to-date, practical guidance rather than empty promises.

Key Takeaways

- Smart choices in insulation, HVAC, solar, and lighting drive actual energy savings between 5% and 30% on average household bills.

- Federal tax credits through 2032 offset upfront costs for many popular upgrades, including up to $2,000 for heat pumps and $1,200 for insulation.

- Not all improvements deliver equal ROI—successful results demand a clear plan, good timing, and careful attention to installation quality.

- What Are Energy Efficient Home Upgrades and Why Do They Matter?

- How to Implement Energy Efficient Home Upgrades: Step-by-Step

- Advanced Analysis and Common Pitfalls

- Conclusion

- Frequently Asked Questions

What Are Energy Efficient Home Upgrades and Why Do They Matter?

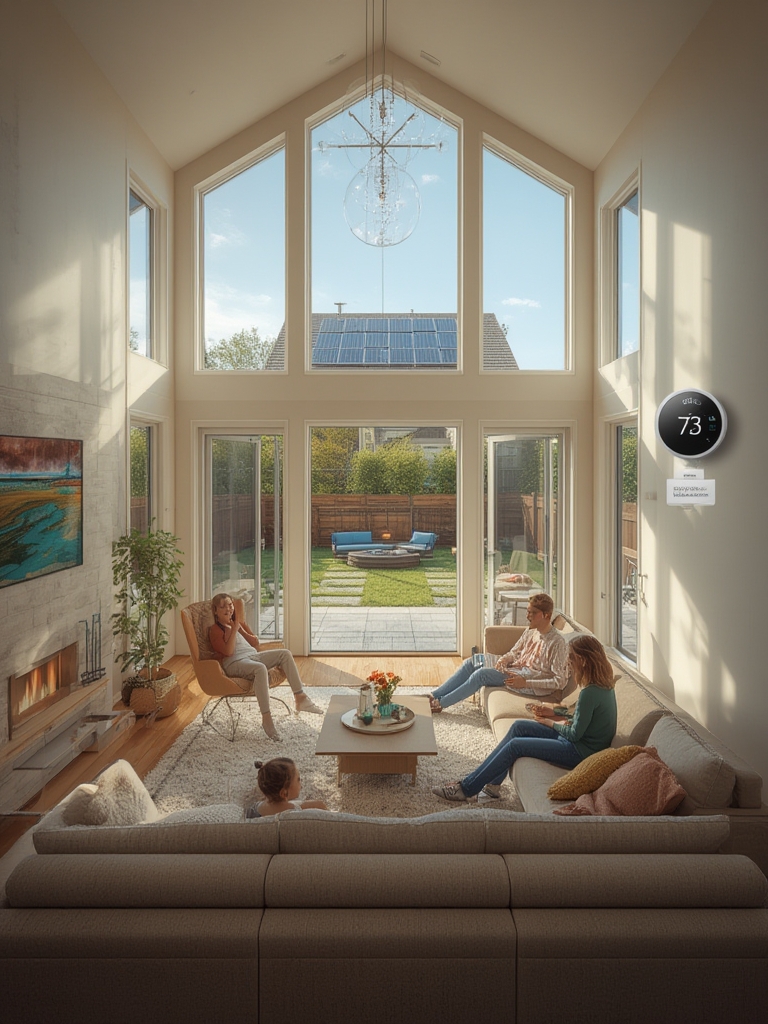

Energy efficient home upgrades are targeted improvements to your home’s envelope, mechanical systems, or appliances that cut your utility costs and reduce waste. These can be small projects—like swapping out incandescent bulbs for LEDs—or major investments such as solar panel installation. In 2024, more homeowners than ever are chasing these upgrades, motivated not just by environmental benefits but by new financial incentives and volatile energy prices.

Here’s what current data shows:

- Solar panels are saving a median of $2,230 annually per home.

- Efficient heat pumps deliver $600 to $3,100 in annual savings, depending on what system they replace.

- Insulation and air sealing allow families to claim up to $1,200 in credits, with 700,000 families taking advantage in last year alone.

- LED lighting uses 75% less energy than incandescent, making fast, cheap impacts.

- ENERGY STAR home upgrades save roughly $450 a year, according to the EPA.

Unlike generic home updates, these upgrades target persistent energy loss. Projects like those featured in our latest window sealing kit review further optimize draft control and comfort, compounding year-round savings. Whether your aim is environmental stewardship or simple bill-cutting, these upgrades pay off in real household budgets.

How to Implement Energy Efficient Home Upgrades: Step-by-Step

Here’s a realistic action plan to help you maximize the return on your investment—whether you’re a hands-on DIYer or prefer contracting out the work.

- Schedule a Home Energy Audit:

- Professional audits are eligible for up to $150 tax credit (visit IRS or Consumer Reports for details).

- Get a detailed report on where your energy loss is happening—attic, ducts, window seams, etc.

- No official data compares DIY to pro audits—however, only the professional version is currently credit eligible.

- Seal Drafts and Insulate:

- Seal attic penetrations, rim joists, basement sills, and window/door frames. Even renters can install basic insulating window tapes or kits.

- Upgrade or top off insulation in attics, walls, and floors where gaps are found. Insulation and sealing can translate to 5-30% savings in bills, and up to $1,200 credit.

- For step-by-step, refer to our draftproofing tape tutorial.

- Upgrade Lighting and Appliances:

- Replace incandescent and CFL bulbs with LEDs. Cut lighting energy use by up to 75%.

- Seek ENERGY STAR appliances to maximize eligibility for credits and lower ongoing costs—not all appliances are covered, so confirm before purchase.

- Select Smart Controls and High-Efficiency HVAC:

- Install a smart thermostat (yields 10% annual savings, plus $100 in further savings over a standard programmable model).

- Elect for Energy Star-rated HVAC systems, heat pumps, and consider weatherization around vents and ductwork.

- Plan Major Upgrades Like Solar Wisely:

- Solar panels have high upfront cost but median savings of $2,230 per year and $30,000+ over system lifetime.

- Solar tax credits are available yearly through 2032. Payback period varies, but regions with higher energy costs or sunlight achieve ROI faster.

- Understand Tax Credits and Paperwork:

- Federal credits cover qualifying doors, windows, insulation, HVAC, audits, and major renewables. Submit documentation with your annual tax return (no additional application forms required for most homeowners).

If you have a covered outdoor living space, be sure to include upgraded insulation or weatherized patio doors—see our guide on creating comfortable year-round spaces.

Need to finance bigger upgrades? Our practical guide to home financing options covers the essentials from quick deck repairs to full major upgrades.

Advanced Analysis and Common Pitfalls

Digging deeper into actual installation experience and the latest federal incentives, here’s what often goes wrong and where to focus if you want evidence-based results.

Common Pitfalls

- Choosing Upgrades with Low ROI: Not every project results in big savings. Some low-end window replacements offer little impact. Check third-party data and prioritize envelope improvements first.

- Improper Installation: DIY jobs often fail to fully air seal, or installers rush insulation—greatly reducing effectiveness. Detailed guides, like those on finishing and sealing wood projects, can help prevent these issues.

- Paperwork Mistakes for Tax Credits: Documentation for credits must be retained—missed receipts or unclear product eligibility may mean a missed deduction.

- Regionally Variable Savings: Savings and payback time for upgrades like solar or insulation vary widely across the US due to local costs and climate. For example, Northern Zone homeowners can save $568 per year with single-pane window upgrade, but returns are lower in mild climates.

- Neglecting Regular Maintenance: Upgrades aren’t “set and forget.” Filters, seals, and controls demand routine checks, much like deck maintenance or tile restoration. Our maintenance guides show how preventive care pays off year after year.

- Lack of Accurate Energy Audit: No clear insight into where energy loss is actually occurring can lead to wasted spending—professional audits offer better diagnostics and qualify for a credit, but DIY options aren’t credit eligible.

| Upgrade Type | Avg. Annual Savings | Tax Credit (2024) | Common Pitfall |

|---|---|---|---|

| Solar Panels | $2,230 | 30% of costs | Long payback in low-sun or low-cost regions |

| Heat Pumps | $600–$3,100 | Up to $2,000 | Requires compatible ducting or major retrofit |

| Windows | $253–$568 | Up to $600 | Low savings in mild climates |

| Insulation | 5–30% on bills | Up to $1,200 | Sub-optimal results if air sealing skipped |

| LED Lighting | Up to 75% less energy (lighting budget) | Rarely eligible directly | Wrong color temp or compatibility issues |

Tax credits sometimes change. Homeowners should consult the IRS or a local expert each year before filing for deductions relating to improvements.

Conclusion

Every homeowner can find the right combination of comfort, savings, and value with the right approach to energy efficient home upgrades. Start with a professional audit, fix what matters most first, and always document your improvements for credits. The key to success is matching the right upgrade to your personal goals and local climate. Review installation tips, keep an eye on current federal incentives, and never stop learning—read further with our complete guides to floor preparation and home maintenance strategies. Now is the best time to cut costs with energy efficient home upgrades. Start your assessment this week.

Frequently Asked Questions

How much can I save by upgrading to LED lighting?

Upgrading to LED lighting can reduce lighting energy use by up to 75%, representing around 8–10% of your total energy bill. Actual dollar savings depend on your household usage and utility rate.

What federal tax credits are available in 2024 for home energy upgrades?

Federal credits through the Energy Efficient Home Improvement Credit run through 2032 and cover up to $1,200 for insulation, $2,000 for heat pumps, and 30% for solar panels. Products must meet certain criteria, and professional audits can also qualify for up to $150.

Do smart thermostats qualify for tax credits?

Smart thermostats themselves are not always directly credited, but they are often required as part of HVAC system upgrades, which may be credit eligible. Always check eligibility before purchasing.

Is a professional energy audit worth it?

Yes, a professional audit is often worth the cost, especially since it is eligible for a $150 tax credit and delivers a prioritized list of improvements. DIY audits may miss major issues and do not count towards tax credit eligibility.

What is the most important first step for lower energy bills?

Most experts agree that sealing air leaks and adding insulation make the biggest impact in typical homes. These improvements are the foundation for all other energy upgrades.

[…] other home improvements alongside smart home upgrades, you might also want to read about energy efficient home upgrades to maximize your […]